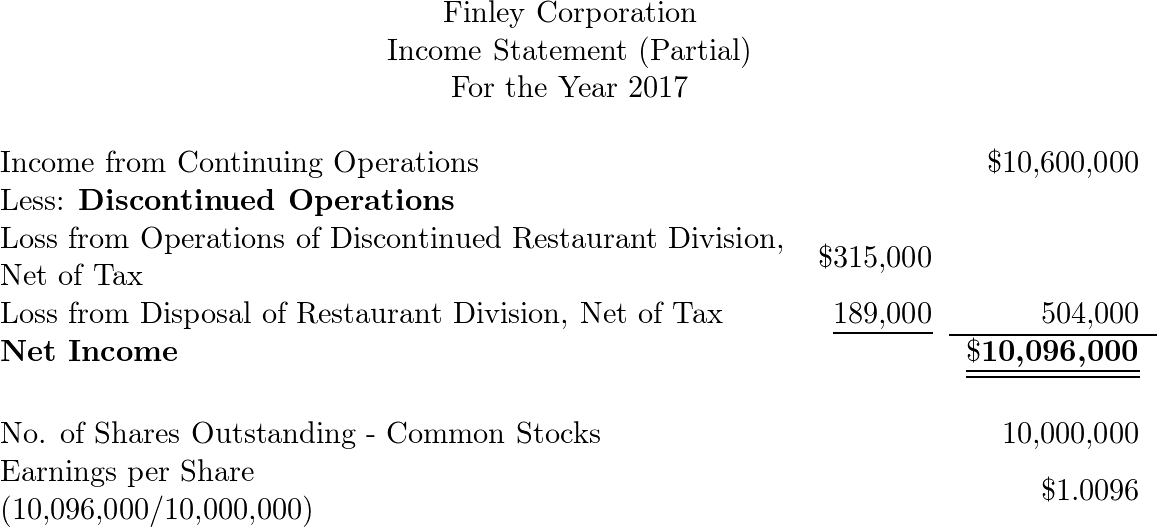

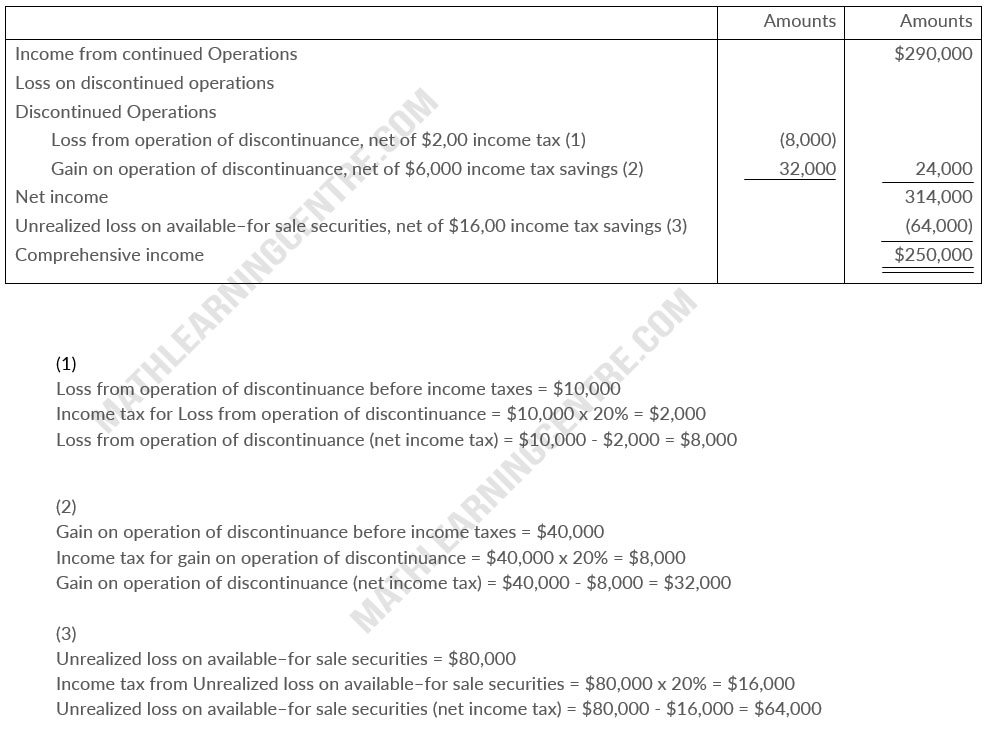

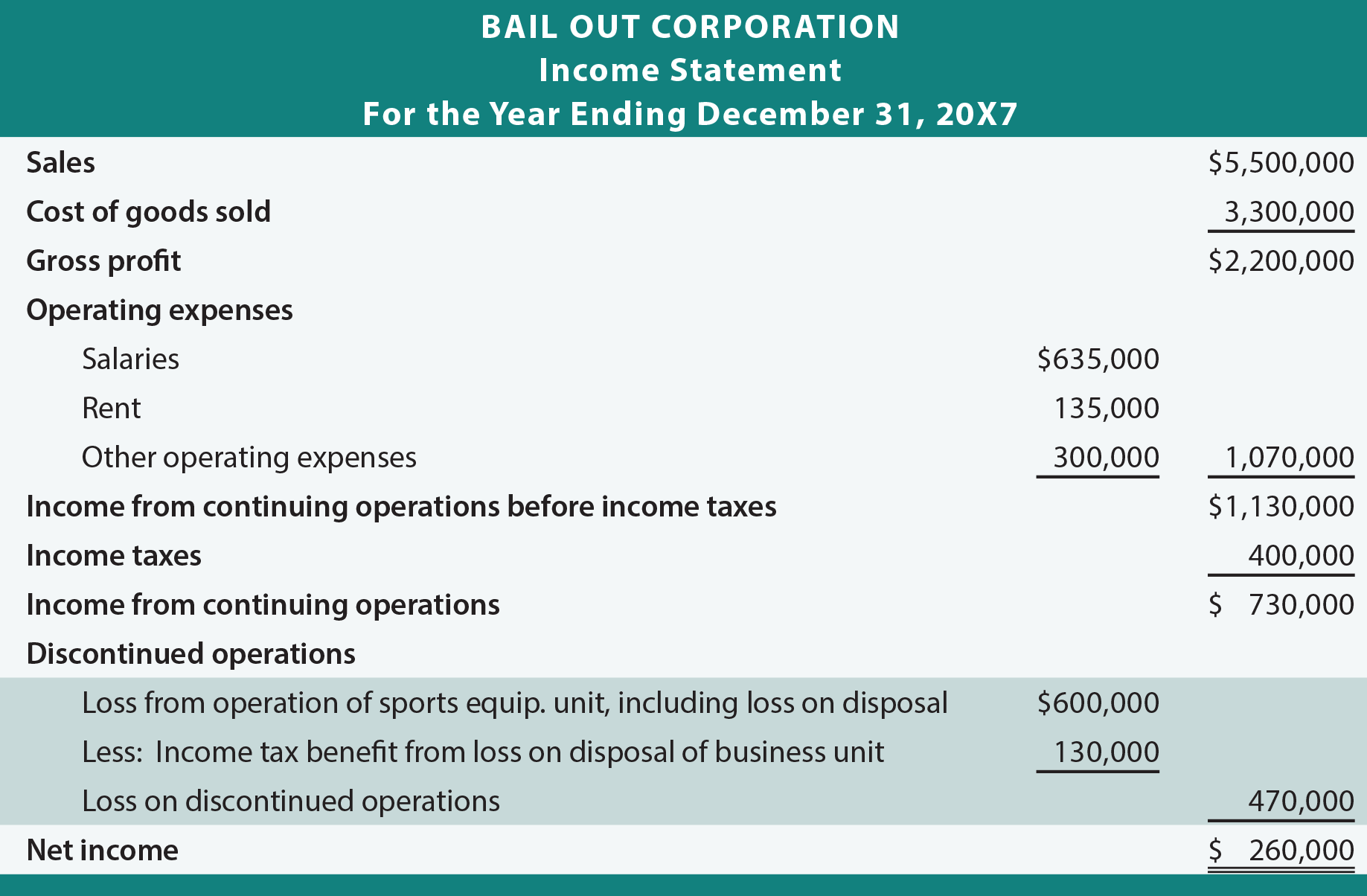

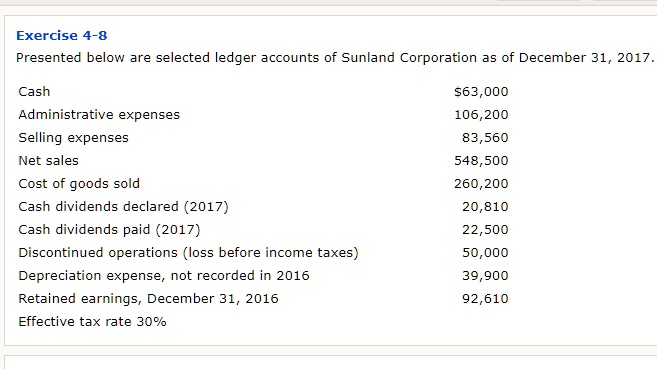

SOLVED: Compute net income. Prepare a partial income statement beginning with income from continuing operations before income tax, and including appropriate earnings per share information. Assume 21,320 shares of common stock were

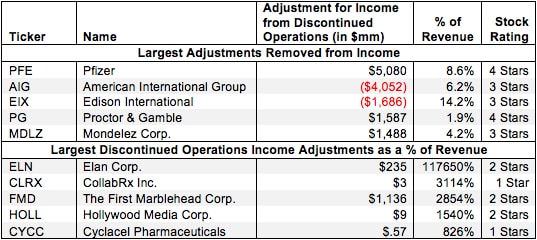

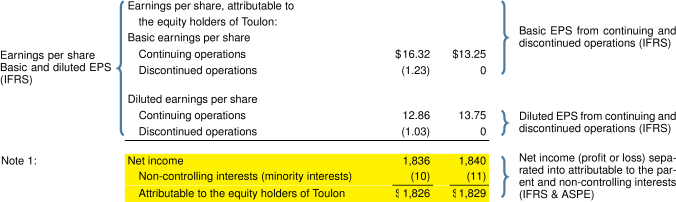

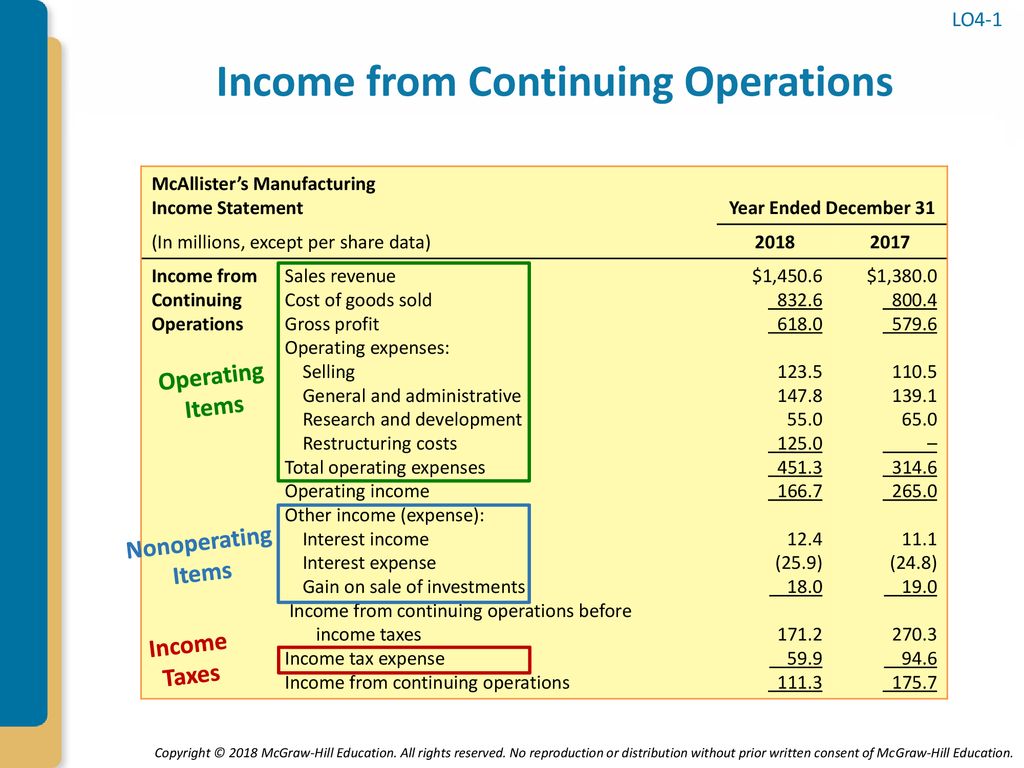

Chapter 4 The Income Statement, Comprehensive Income, and the Statement of Cash Flows This chapter has three purposes: (1) to consider important issues. - ppt download